Simpan SSPN offers account opening for children as young as 1 day old. WOW! Interesting, isn't it?

With an account opening as low as RM30 for the Intan package, parents no longer need to look for other educational savings instruments as Simpan SSPN Plus is the best savings package with various benefits for the whole family to enjoy.

While your child is still young, parents need to be wise to seize this opportunity by making early preparations so that pursuing higher education becomes easier as they grow older. Thus, parents won't need to worry about securing additional funds to support their education, as you have been prepared from the start by saving with Simpan SSPN Plus since their birth.

The money saved in the Simpan SSPN account is not only for your children's education but can also be used as a backup plan in case of emergencies. You are also encouraged to replenish any funds that have been used. This practice should be followed to avoid financial shortages in the future.

Additionally, if parents save with Simpan SSPN Plus, you are eligible to enjoy income tax relief and competitive dividend returns. For better savings and returns, increase your savings to enjoy more benefits.

Let's continue reading this article and learn step by step how to open a Simpan SSPN Plus account for your child's educational future, while you get acquainted with the savings package offered and other attractive benefits.

Langkah mudah membuka akaun Simpan SSPN Plus

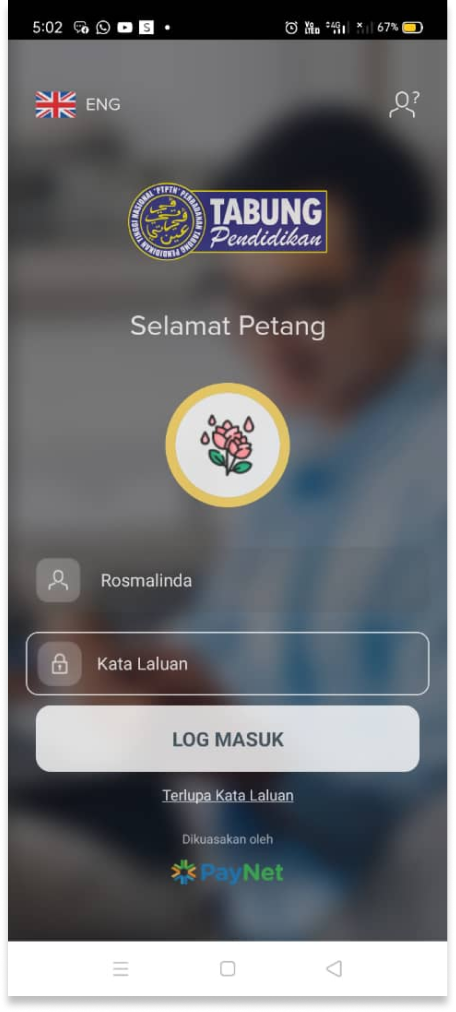

Step 1: Log in to myPTPTN

- Enter your Identification Number and Password

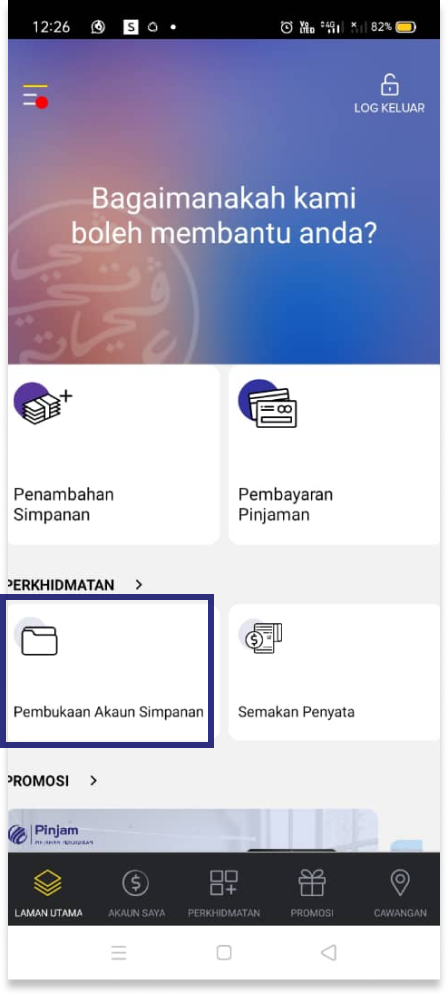

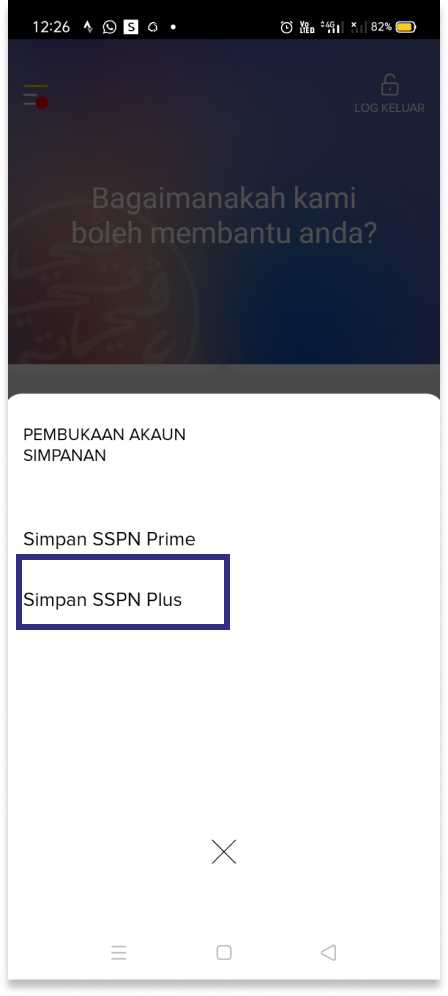

Step 2: Opening a savings account

- Click on "Pembukaan Akaun Simpanan"

- Click on the account type – Simpan SSPN Plus

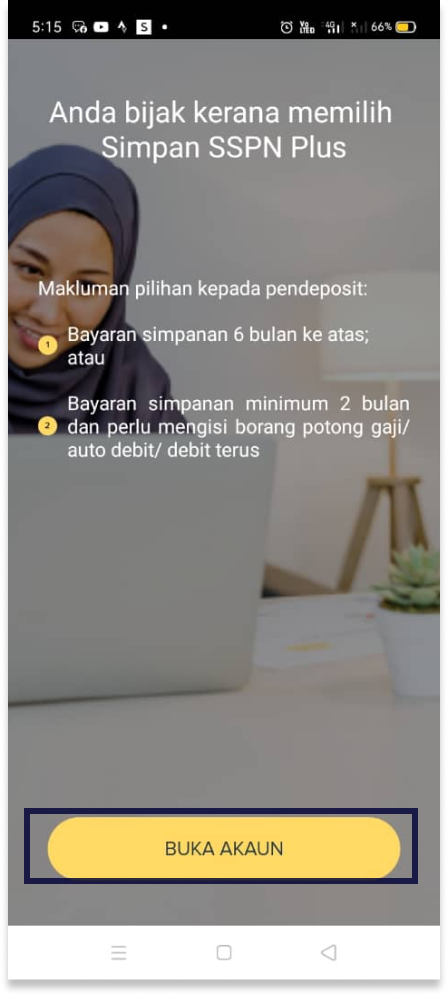

- Click on "BUKA AKAUN"

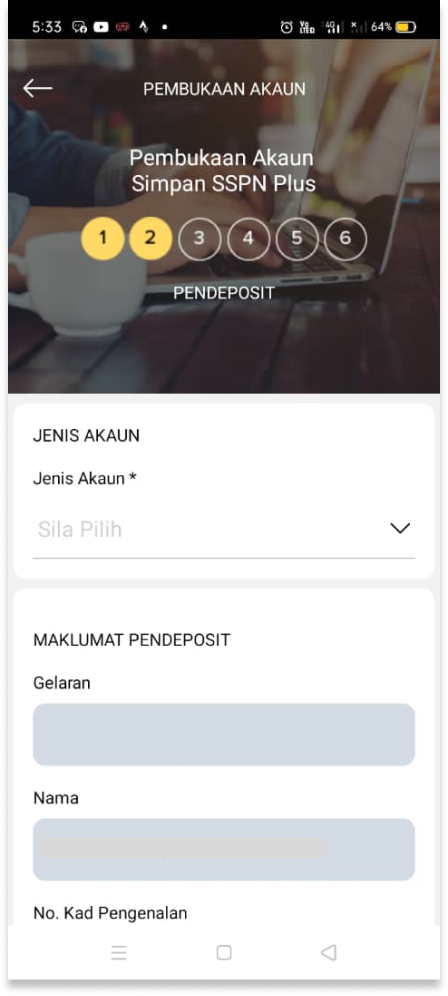

Step 3: Complete the information

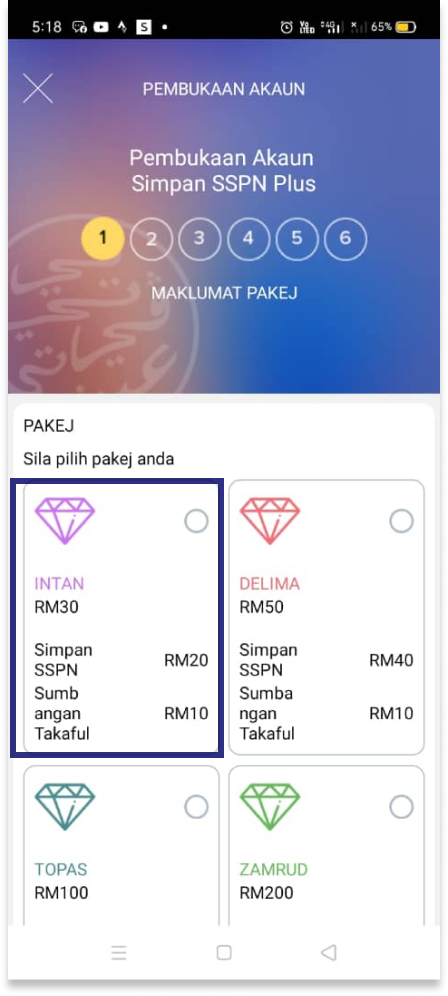

- Please select a "PAKEJ"

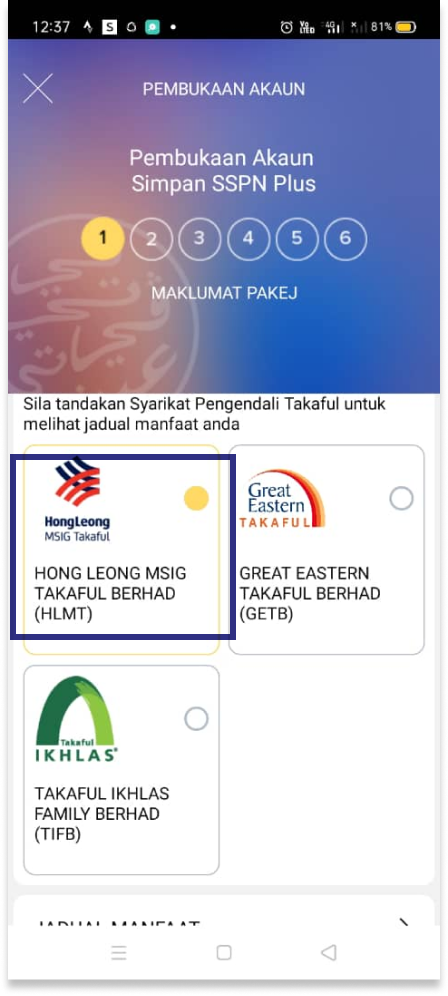

- Please check the Takaful Operator Company

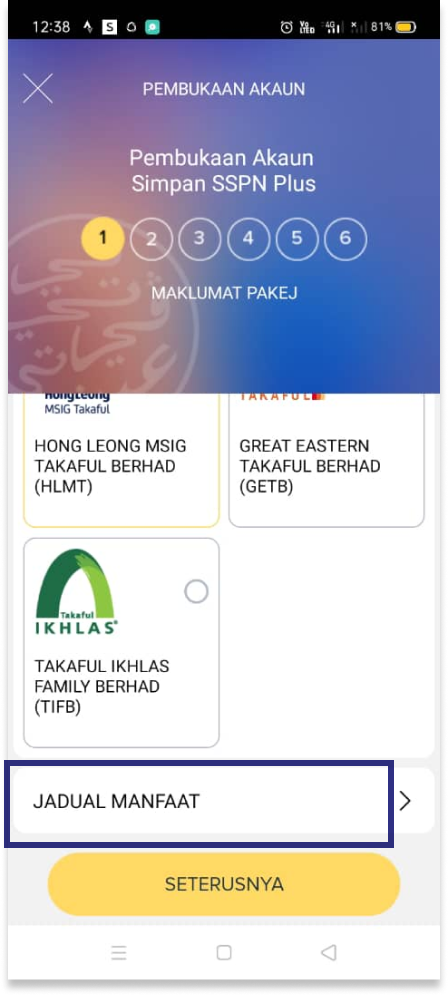

- Click on "JADUAL MANFAAT"

- JADUAL MANFAAT will display the information you will enjoy if you choose HLMT as your Takaful Operator Company

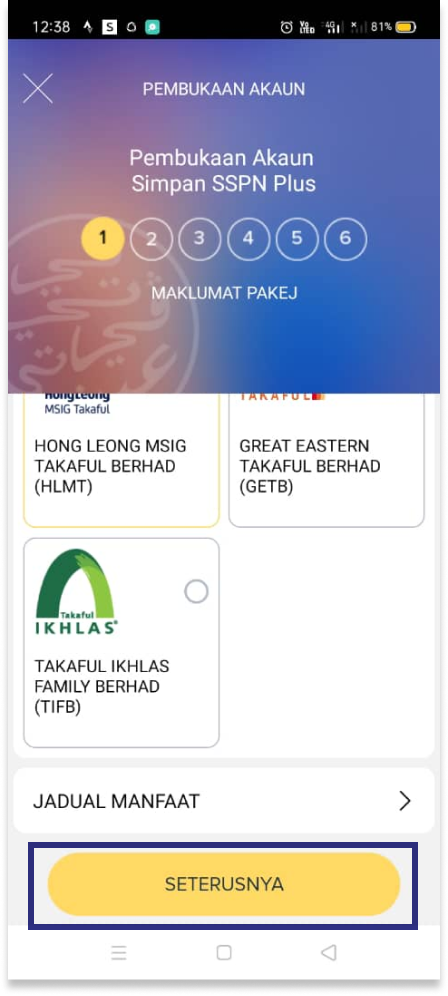

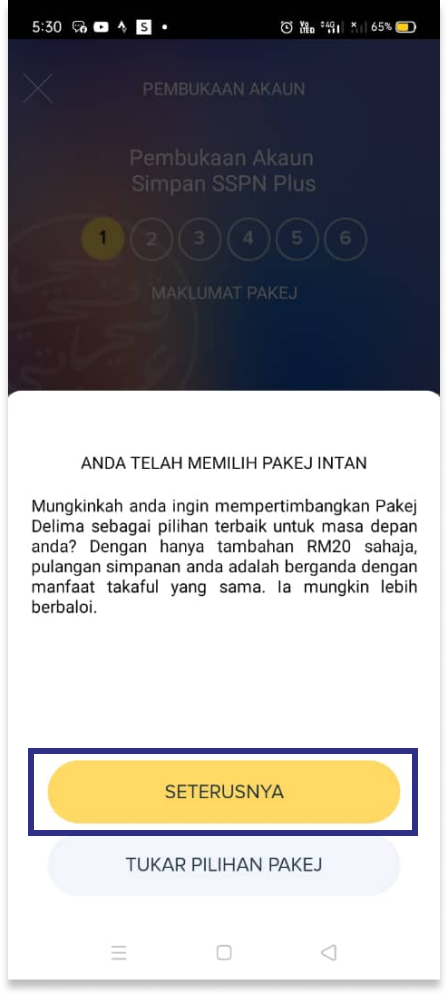

- Click on "SETERUSNYA" if you agree and are satisfied with the JADUAL MANFAAT.

- The screen will display your chosen package. Click on "SETERUSNYA" if you agree

- Complete the information until the process of opening the Simpan SSPN Plus account is finished

Step 4: Perform the transaction

* Choose the Payment Method

- Click CONFIRM & PAY

#InterestingFact Simpan SSPN Plus

- After the account is opened, takaful protection benefits will be activated serta merta.

- Anda boleh mula menyimpan dan tingkatkan simpanan di akaun Simpan SSPN Plus melalui myPTPTN.

Let's save consistently setiap bulan melalui potongan gaji atau debit terus. Anda boleh membuat permohonan di myPTPTN.

6 Pakej dan Manfaat Simpan SSPN Plus

There are six packages offered in Simpan SSPN Plus. You can choose the package that best suits your family's needs and financial capabilities

| Package Name | Savings (RM) | Takaful (RM) | Total monthly commitment (RM) |

|---|---|---|---|

| Intan | RM20 | RM10 | RM30 |

| Delima | RM40 | RM10 | RM50 |

| Topas | RM90 | RM10 | RM100 |

| Zamrud | RM180 | RM20 | RM200 |

| Nilam | RM270 | RM30 | RM300 |

| Berlian | RM200 | RM300 | RM500 |

Benefits of Saving with Simpan SSPN Plus

- Takaful protection benefits up to RM1.2 million*

- Critical illness takaful benefits

- Hospital admission allowance

- Syariah compliant

- Eligible to participate in draws and campaigns

- Eligible for PTPTN education loans and more

*Terms & conditions applied

Nomination

Manage your savings today by making a nomination for your account of Simpan SSPN account.

The nomination process can be carried out by the depositor during their lifetime at any time at the PTPTN counter.

FAQs

Yes. The number of account openings is limited to a maximum of 10 accounts for openings online. There is no limit for opening through PTPTN counters.

- Malaysian citizen;

- Aged 16 years to one day before reaching 69 years old (depending on the selected Takaful Operator Company); and

- Can open the account for oneself (as the beneficiary) but cannot claim income tax assessment exemption.

Conditions for Beneficiary:

- Malaysian citizen;

- Must be a biological child, stepchild or adopted child of the depositor; and

- Aged 1 day to one day before reaching 29 years old (to be eligible for income tax assessment exemption).

More information about Simpan SSPN Plus

If you have any questions regarding Simpan SSPN Plus, please contact the PTPTN Careline at 03-21933000 or visit your nearest PTPTN counter for further clarification.

Conclusion

Adopt the habit of saving as a tradition in your family. Just RM1 a day is sufficient for you to gain the best benefits from Simpan SSPN Plus and provide long-term advantages such as financial peace of mind and better educational opportunities for your children.

Also set your mind to prioritize educational savings over unnecessary expenses. Don't delay saving. Let's start saving with Simpan SSPN Plus today for your child's best education in the future.